Author and archaeology enthusiast

Rob Mac Gregor is the recognized author of SF and Fantasy. In 1996, he received the Edgar Allan Poe Award for one of his novels.

Main Topics

Before devoting himself to writing fiction, he was first a reporter, which allowed him to travel a lot around the world. He focuses on various themes

- Discovery

- Adventure

- Travel

- Combat

Popular Culture

Mac Gregor has participated in several films and English novels. This allowed him to continue his way to the professional world. His know-how in this field opened the way for him.

Explore The Most

Follow Us For More News About Rob MacGregor

Rob Mac Gregor’s Books

Rob Mac Gregor Has Written Several Books

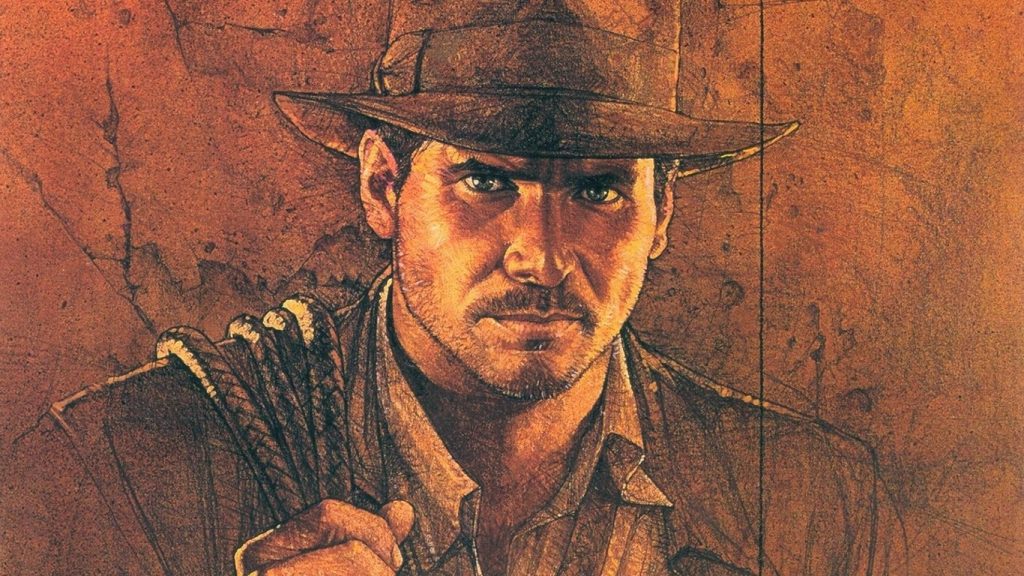

Indiana Jones And The Dance Of The Giants

Early history of Indiana Jones, who just got his first teaching position in the archaeology department of the University of London.

The Last Crusade

Indiana Jones is back. Nazis can't sense the things that others have sensed, but he's not going to let them get their hands on the secret of immortality.

The Curse Of The Unicorn

It would be a magical replica capable of conferring exceptional powers. Evil or beneficial, according to the good will of the one who will seize it.

Noah's Ark

A perilous adventure, full of pitfalls, because before reaching Mount Ararat, they will have to get rid of Al Capone in Chicago and the dreaded Janissaries in Cappadocia.

The Inner World

It all starts with an ordinary excavation site on Easter Island, where old Indy makes some rather unexpected finds.

The Seven Veils

Back from a perilous archaeological mission in Tikal (Guatemala), Indiana Jones has just landed in New York when a dark case breaks out.

His Best Books

Rob MacGregor In Mass Culture

Indiana Jones And The Last Crusade

Indy now understood that the chalice was the essence of a higher consciousness, which existed in anyone who would take the trouble to seek it.

I’m sorry to tell you this, but it seems to me that it would be better for you to keep this adventure to yourself, especially the episode of your meeting with Noah.

It says that fools like you, Colonel, would do better to read the books, instead of burning them in public!

“Go get me the Moly”, his father had once ordered him. When Indy confessed that he didn’t know what it was, he was forced to eat a clove of garlic every day until he discovered why the condiment was called that.

Reviews

What Rob MacGregor Fans Are Saying

Become A Fan

We Are Pleased To Welcome You As A Fan Of Rob MacGregor

This site is dedicated to fans of Rob MacGregor.

We like here your reviews of his books, his best quotes and other information about him.